If you are standard for small amounts, this type of choices might not be best if you’d like a more impressive financing or even more time and energy to repay. Note that rates and charge might be apparently higher — you can even pay an origination percentage away from 5.25% so you can 9.99%, and you will APRs start from the eleven.69%. If you get a loan with a high rate of interest, consider refinancing your own financing from the a lesser speed after you have increased your credit score. Your own financing can also decrease your credit use for many who make use of it to pay off personal credit card debt otherwise lines of borrowing from the bank. Borrowing application ‘s the number of readily available borrowing from the bank make use of to your rotating debt such playing cards. Their borrowing from the bank application ratio is but one grounds affecting the fresh amounts due sounding your own FICO get, and this makes up 29% of your full score.

Thanks for bringing views! We’re sorry didn’t works.

I also informed my personal financial that the business will get you will need to charge not authorized purchases as the girls informed me they’d getting delivering in a few weeks. We never received one funds from Splash Dollars, nor performed I sign people documents for a financial loan. I am not sure what happened the 1st time, for the reason that it financing processes are easy.

How to combine payday loan

As well, lenders typically have requirements of ages and you may citizenship for personal finance. Certain loan providers and you will things might not wanted a credit score assessment, but be equipped for higher costs, rates, and you may restricted borrowing from the bank number. Costs is actually greater than competitors and OneMain costs origination charge while the both a condo fee around $five hundred, or a percentage from% to 10% (according to a state away from residence). Keep in mind that even if you prequalify to possess your own mortgage which have OneMain, delivering approved isn’t a given. Using the same analogy, the two-season financing could have a payment per month from $177, versus you to definitely-year loan’s percentage of $301 a month.

In fact, the business supplies the right to obtain your credit report at the at any time to help you reassess the https://mrbetlogin.com/cold-cash/ borrowing limit. If you live paycheck-to-income no self-reliance on your own finances, level these expenses might be challenging. The Elastic line of credit review tend to walk you through how borrowing from the bank because of Flexible works, when it is reasonable, just what some of the significant disadvantages is actually, and you may alternatives to an enthusiastic flexible personal line of credit. All of the LendKey debtor also needs to get done a degree of an enthusiastic qualified school and all sorts of people need to be a good U.S. resident or permanent resident in order to be considered. This short article reviews the best techniques to get this happens.

Alternatives in order to personal loans for bad credit

- Rather than almost every other cash advance programs, Flexible isn’t tied to your own income (even when your earnings influences their credit limit), and you can rather than almost every other credit lines, fees is actually apartment cost instead of a percentage.

- Including, refinancing $one hundred,100 inside education loan financial obligation of a ten-12 months identity to help you an excellent 30-year name during the mortgage loan away from 6% you may lower your monthly obligations by the more $five-hundred 30 days.

- Credible’s party out of professionals attained guidance of for each and every lender’s web site, customer support company, in-family information and via email support.

- Cash-out refi financing will likely be a great fit if you would like in order to tap into your property collateral but like one monthly home loan percentage more a few.

Default comes at the conclusion of an extended procedure after you are unable to make your necessary monthly payments. On the day after you miss very first commission, you then become unpaid in your fund. One more thing to imagine on the an extended loan label is if you’ll have a fixed otherwise variable rate of interest. A fixed interest, which all the federal finance have, assists in maintaining your repayments secure more all of your loan label. A variable-rates loan tend to have a lesser initial rate of interest, possibly causing biggest rate movement that could be tough to the your budget.

However, if you are personal line of credit and personal loan uses are usually wider, we recommend only using Flexible’s credit line to own extremely particular intentions, because of its higher costs. Sadly, citizens inside the Maine, Las vegas, North Dakota, Rhode Area, and Western Virginia do not be eligible for fund having one LendKey spouse loan providers. However, LendKey does direct borrowers when it comes to those claims to Sallie Mae to view private financing.

The current interest rate on the an excellent 15-12 months home loan are 5.99%, 0.twenty six payment issues lower than yesterday. The new median rate of interest on the an excellent 30-seasons repaired-rate mortgage is actually 6.88% as of March 14, that’s 0.eleven payment issues less than yesterday. At the same time, the new median rate of interest to your an excellent 15-season repaired-rates home loan are 5.99%, that is 0.twenty six percentage points lower than past. Boosting your earnings is a feasible alternative rather than borrowing the bucks you desire, especially if you do not require an enormous loan. Cost trended up away from 1971, if the Provided become tracking her or him, getting one to number filled with 1981, having peaks coinciding that have recessions.

Loan providers also consider the debt-to-money ratio (DTI), which compares your own month-to-month financial obligation costs to your earnings. Splash recommends a great DTI lower than 30% to improve your chances of qualifying with among its lenders. You’ll need adequate income to qualify for the mortgage you’lso are trying to get. There isn’t any certified minimum earnings needs; the main issue is you have the ability to pay back the borrowed funds. If you are OneMain Monetary doesn’t have the absolute minimum credit history specifications, your own credit and you can credit history was sensed.

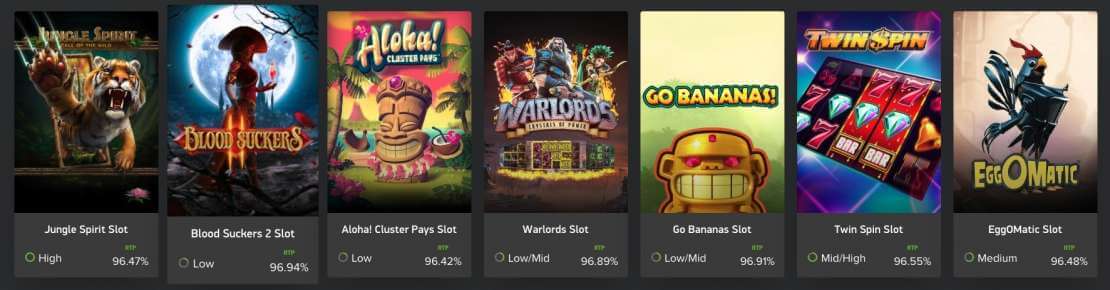

The fresh six.08% mediocre speed for an excellent 30-seasons fixed-speed mortgage said by Freddie Mac computer to the Sept. twenty six is the reduced rates because the March 2023. An excellent 15-12 months mortgage typically has a considerably lower price than simply a great 29-12 months financing. You will find written the major 20 online slots games and modern position machine winners listing to possess.. Simultaneously, for each and every using town team are certain to get products for the endeavor movie director’s work environment within this two months. Among other things, it does were a laptop having app that will help you the new certified to utilize endeavor proposals, and you may create and implement him or her.

- To own individual college loans, the method so you can request a benefits statement varies by the lender.

- Whether or not you’re also the fresh borrower otherwise cosigner, Reputable allows you evaluate costs of several individual student creditors.

- Protecting to have a deposit is a lot easier for many who cover the total amount you want.

- CashSplash Casino limits the amount of money you could winnings from so it added bonus so you can €dos,one hundred thousand.

- Discover where to get a $20,100000 mortgage, what you should think prior to credit $20,100, the different ways to get it done, and you may what to anticipate when it comes to costs.

- From that point, you’ll authorize LendKey to do a delicate credit assessment, that won’t connect with your credit rating.

How long can it sample rating a personal education loan?

Pleased Currency has been doing process while the 2009 (formerly also known as Incentives). It is a choice to have fair-borrowing individuals (as well as people who have greatest borrowing), and you may somewhat features a relatively lowest better-prevent Annual percentage rate. To put it differently, you can qualify for a lesser speed having Delighted Currency which have reasonable borrowing, according to other loan providers that offer fair-borrowing from the bank money. The company really does costs an enthusiastic origination commission to the some finance, as much as 5%, but that’s far less higher as the additional lenders’ origination charge. Another loan providers never give antique payday loans, but may become a good idea if you need a longer installment name or higher amount borrowed. A wage advance on the net is identical to it may sound — a short-term mortgage your create on the web.

In addition to, Splash provides a real time talk ability to get genuine-date answers without having to wait for the hold and for an enthusiastic email. Financing arrive up to $100,000 for those who pertain thru Splash’s web site. There’s constantly no credit score assessment with the loan providers, it generally only requires a few momemts to get approval when you pertain.

If your customer has a great preapproval letter of a loan provider, they’ve been inside a better condition to stick to the purchase than just whether they have but really to apply for a mortgage. They are going to still need to fulfill the lender’s standards (for example having the home appraised), so that the bargain you are going to conceivably slip thanks to, however, this should give you certain encouragement so it won’t. To own small businesses having severe investing, it welcome added bonus provide can be extremely satisfying. The administrative centre You to definitely Spark Dollars in the past seemed a welcome render out of $750 after 50 percent of the brand new paying dependence on the newest give. The newest render are big but means far more using, therefore don’t receive any longer to satisfy the new spending requirements. Paying $15,000 within 3 months is generally outside of the investing ability from some small enterprises.

As well, the newest statement estimated you to household conversion, which happen to be nevertheless expected to become “subdued” this current year, you are going to climb somewhat while the cost dip. The newest up-to-date prediction means a tad bit more breathing area will be coming, however, higher cost and you can limited collection will likely consistently make homebuying an issue. By April 8, the newest average rate of interest to the a 31-12 months fixed-rate mortgage is 6.88%, 0.twenty five fee items higher than past. Simultaneously, the brand new median interest to your a 15-year repaired-price mortgage is actually 5.75%, which is 0.twelve commission items greater than yesterday.